Why Fintech Teams Use Scala for High-Performance Systems

How Scala supports low-latency, data-intensive fintech workloads, and how teams add Scala expertise without long hiring cycles

Fintech teams face consistent constraints: low-latency requirements for payments and trading, high data volumes for analytics and risk, and regulatory pressure that makes correctness mandatory. Engineering leaders must choose technologies that scale under load while minimizing operational and delivery risk. Scala addresses this by combining a strong static type system, functional programming patterns, and JVM interoperability, making it a practical choice for building reliable, high-performance financial systems.

This article explains why Scala is a practical choice for building high-performance fintech systems. Key points include:

- Strong type safety to reduce runtime errors and financial risk

- Functional programming patterns that improve testability and long-term maintainability

- Proven concurrency and streaming tools for low-latency, real-time workloads

- Native support for data pipelines and analytics through Scala-first platforms like Spark

- Incremental adoption on the JVM without replatforming existing systems

Ultimately, Scala helps fintech teams scale critical systems, improve reliability, and deliver complex functionality faster without increasing operational risk.

1. Correctness and Type Safety in Financial Systems

Financial systems are unforgiving. A small logic error in pricing, reconciliation, or state handling can produce real financial exposure. Scala’s static type system allows teams to encode business rules directly into the code structure, catching entire classes of errors before deployment.

For engineering leaders, this shows up as fewer production incidents, clearer code reviews, and safer refactors as systems evolve. For product teams, it translates to more predictable releases and reduced downstream risk when adding features.

2. Functional Programming for Maintainable Fintech Codebases

Scala encourages immutability and explicit data flows. In fintech environments, where reproducibility, audit trails, and deterministic behavior matter, this reduces hidden side effects and makes systems easier to test and reason about.

Pricing engines, reconciliation pipelines, and compliance workflows benefit directly. Teams spend less time diagnosing unexpected behavior and more time extending systems with confidence.

3. Concurrency and Low-Latency Processing with Scala and Akka

Many fintech workloads are inherently concurrent: payment processing, order matching, real-time risk evaluation, and decisioning systems all depend on predictable throughput and fault isolation.

Scala’s ecosystem includes mature actor- and stream-based tooling that supports message-driven architectures, back-pressure, and graceful failure handling. These models have been proven in production financial systems where availability and responsiveness are non-negotiable.

4. Scala for Big Data, Streaming, and Machine Learning

Fintech is increasingly data-driven. Fraud detection, behavioral scoring, portfolio analytics, and algorithmic trading all rely on scalable data processing.

Scala is the native language of Apache Spark and remains the most direct way to build batch and streaming analytics without unnecessary abstraction. Teams benefit from lower boilerplate, stronger typing in data transformations, and clean integration between real-time services and offline analytics.

For companies building end-to-end pipelines, ingestion, scoring, monitoring, Scala reduces friction across the stack.

Read More: How Scala Powers Big Data Solutions

5. Incremental Scala Adoption on the JVM

Most financial organizations already run on the JVM. Scala interoperates directly with Java, allowing teams to introduce it selectively rather than rewriting entire platforms.

This makes Scala well-suited for incremental modernization: new high-risk or performance-sensitive services can be built in Scala, while existing Java systems continue to operate unchanged. Teams gain benefits where they matter most, without destabilizing the broader environment.

6. Performance, Observability, and JVM Operations

When written well, Scala services on the JVM deliver strong throughput and low latency while retaining access to mature tooling for profiling, observability, garbage collection tuning, and production debugging.

For teams running mission-critical systems, this operational maturity matters as much as raw performance. Scala fits naturally into established CI/CD pipelines and cloud-native deployment models.

7. Scala Ecosystem Stability and Long-Term Viability

Choosing a core language is a long-term decision. Scala continues to receive active investment in tooling, language evolution, and developer experience. That stability reduces platform risk for fintech systems expected to run in production for years.

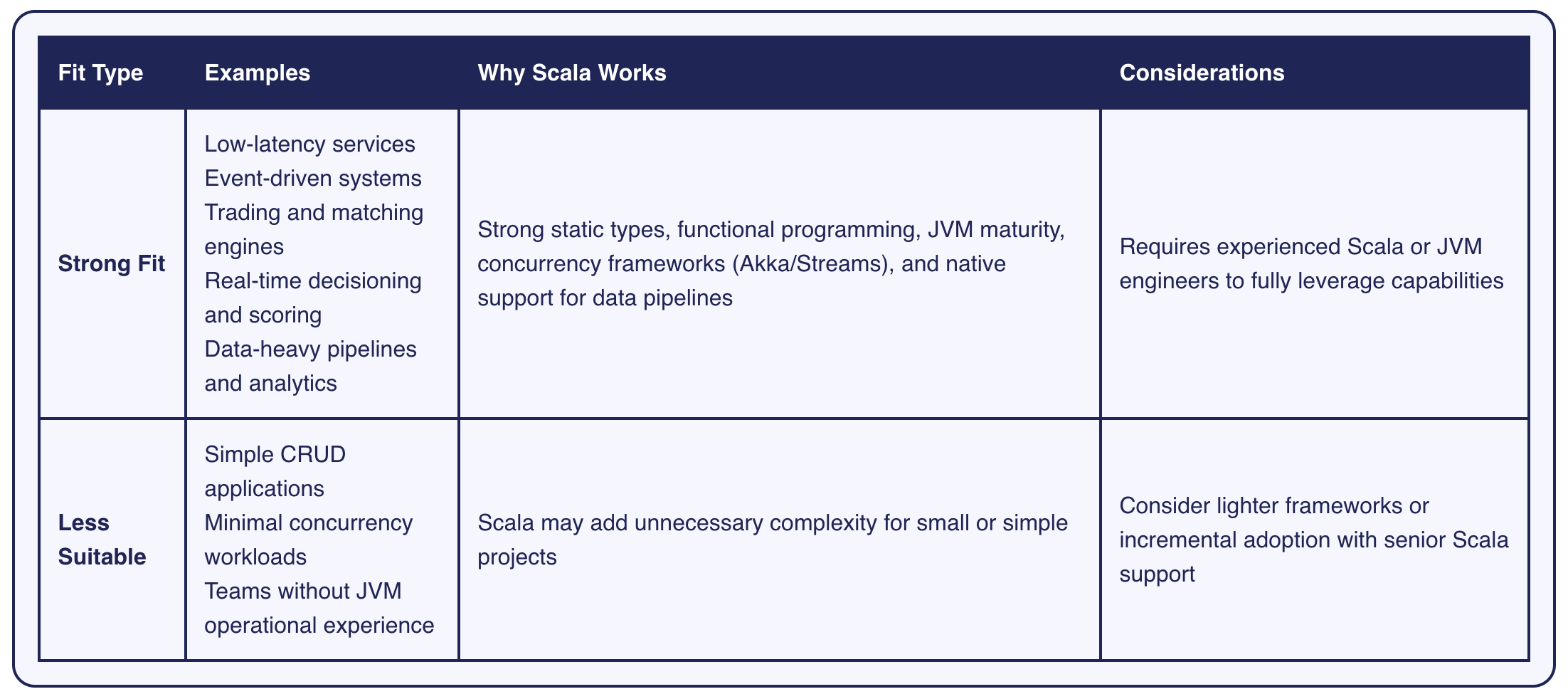

When Scala Fits and When it Doesn’t

Scala is ideal for systems that demand high performance, precise correctness, and robust concurrency. Its strong type system and functional programming patterns make it well-suited for building event-driven services, trading engines, real-time scoring pipelines, and data-intensive analytics platforms. However, for simple CRUD applications or teams lacking JVM expertise, Scala may introduce unnecessary complexity. In these cases, lighter frameworks or incremental adoption with senior Scala support can help balance productivity and maintainability.

Strong fit:

Low-latency services

Event-driven systems

Trading and matching engines

Real-time decisioning and scoring

Data-heavy pipelines and analytics

Less suitable:

Simple CRUD applications with minimal concurrency

Teams without JVM operational experience, unless paired with experienced Scala engineers

Practical Adoption Patterns for Fintech

Staff Augmentation to Reduce Early Risk

Many teams bring in senior Scala engineers to design core services, set architectural patterns, and mentor internal developers. This shortens ramp-up time and avoids early design decisions that create long-term friction.

Hybrid Roadmaps

A common approach is to build the most performance-critical or complex components in Scala while integrating with existing Java systems via stable APIs. This delivers immediate value without broad replatforming.

Pairing Architecture with Observability

Strong typing and functional design improve local correctness, but distributed systems still require rigorous testing under load. Successful teams invest early in observability, load testing, and failure scenarios alongside Scala development.

Read More: Building High-Performing Offshore Engineering Teams

What to Look for in Senior Scala Engineers

Production experience with concurrent or stream-based systems

JVM performance tuning and observability knowledge

Hands-on experience with Spark or Scala-native data tooling when analytics are involved

Ability to mentor and establish maintainable functional patterns

How Scala Teams Works with Fintech Companies

Scala Teams partners with fintech companies that need Scala expertise without long hiring cycles. We embed senior engineers into existing teams or deliver full production systems, with a focus on knowledge transfer and operational reliability.

Typical engagements include:

Real-time decisioning services built in Scala

Data platforms using Scala and Spark for analytics or model scoring

Staff augmentation to accelerate delivery while strengthening internal capability

Our goal is to build systems that businesses understand and operate confidently.

Scaling Fintech Systems with Confidence

Scala isn’t a universal solution, but for fintech systems that demand correctness, concurrency, and data-intensive processing, it is a practical and proven choice. Its combination of strong typing, functional design, and JVM maturity supports systems that scale without becoming brittle.

For teams looking to reduce risk, accelerate delivery of critical components, and integrate advanced data workflows without rebuilding their entire stack, targeted Scala adoption is an efficient path forward.

If you’re evaluating Scala for a new fintech initiative or need senior Scala support to move faster, Scala Teams can help define the right scope and engagement model for your goals.